Good Potential for AC Growth in Latin America despite challenges ahead

While Latin America is at a crossroads economically as a result of the strong US economy and the slowdown in Chinese growth, the potential in the Air Conditioning industry remains strong as international and domestic investments fuel the demand.

The economic cycle in Latin America has changed from one of rapid expansion to one of increased uncertainty. Following the lifting of COVID-19-induced restrictions, GDP statistics skyrocketed. By the end of 2022, most economies had recovered to pre-pandemic levels. However, politically, the region has been increasingly volatile, following several government changes.

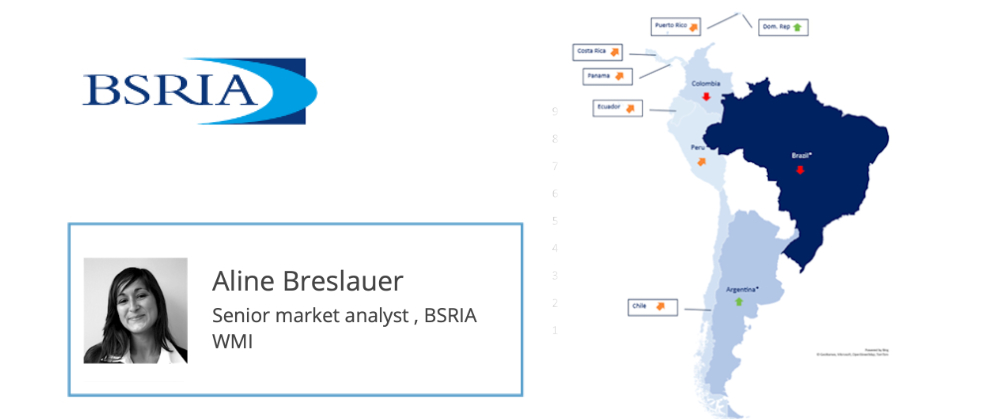

BSRIA recently undertook a new series of research on the Latin American Air Conditioning market to assess if it has been affected by growing political uncertainty.

BSRIA market experts analysed the performance of Chile, Costa Rica, Colombia, Dominican Republic, Ecuador, Panama, Peru and Puerto Rico AC markets.

The results of BSRIA’s LATAM Regional study indicate that, despite political uncertainties and uneven economic performance, most local AC markets kept performing positively in 2023.

All markets – except from Colombia - posted annual growth rates between 2% and 19% by volume of units sold in 2023.

Brazil, Mexico and Argentina kept recording the largest volume of sales with respectively 5.1m, 1.9m and 1m of both packaged and central plant AC systems sold in 2023.

The Brazilian market performed strongly in 2023, where buoyant economic growth, falling inflation and interest rates and weather extremes boosted the demand. More specifically, residential AC increased after stock levels depleted, especially by the end of 2023, because of disruptions at the production sites in Manaus. Success in the residential and light commercial Brazilian markets is heavily dependent on the availability of production sites in the country. Most of the manufacturing facilities, which are, in reality, assembling sites for imported components, are in the free-tax area of Manaus, Amazonas. Producing locally allows for more aggressive pricing. In commercial AC, where most of the units are imported, logistics is the most important factor.

Record-high foreign investments, favoured by the nearshoring policies of the main American corporations, stimulated economic growth in Mexico and gave a push to commercial AC especially. A gradual fall in inflation also contributed to improving consumer confidence and spending despite the high interest rates in 2023. The Mexican minisplit market grows substantially with the emergence of a new multi split segment. but inverter conversion is still slow. On the Applied business, the sales of chillers jumped, stimulated by investments in the industrial market and in data centres.

Despite unfavourable economic circumstances, with GDP falling by more than 2% in 2023, almost all market segments grew since the deep slump experienced during the pandemic. The residential sector remains by far the biggest with huge high wall split market, with sales being close to 900,000 units in 2023, Argentina still has a significant windows market and also a large portables market. Both the light commercial and the VRF markets grew in 2023, reaching around USD 45 million. Chillers represent a relatively small segment in Argentina, with the market reaching about USD 13 million in 2023.

Most countries in Latin America are exposed to climate change and the increasing risk of weather extremes. Combined with the El Nino phenomenon, climate change has been boosting the adoption of air conditioning.

However, we observe huge discrepancies in terms of penetration of AC across the countries and therefore, different levels of maturity on the various product segments we cover:

- portable and mobile air conditioners,

- splits and VRF,

- rooftop and indoor packaged,

- chillers and airside.

While the market for window units declines, mini-split sales increase and an emerging market for multi splits and residential mini VRF expands rapidly. Inverter adoption progresses fast.

The light commercial market, including VRF and rooftops, continues to recover from the post-pandemic slump. Maxi VRF adoption is further expanding, especially in mixed DX & chiller water applications. The applied market records a trend toward smaller, modular units and air-cooled units. The main reason reported was shorter lead times for these products compared to the large capacity ones.

Inverter technology is raising in popularity in the chiller segment overall, as concerns over energy savings and rising operating costs grow. The same is true in the packaged AC segment where the ratio of split inverter has now passed the 40% threshold in all the countries in the region. In Brazil, the new rules approved by the Minister of Mines and Energy in 2022 go even further by phasing out on-off residential air conditioners from 2026.

Other central American countries follow RTCA standards. These rules make labelling stricter and set minimum energy efficiency standards for air conditioners. 16 SEER is a general minimum required of any AC unit to be allowed to be imported. The aim of the regulation is to prevent poor quality imports.

On the environmental impact front, a timid move away from high GWP refrigerants starts to be seen with R32 benefitting the most from it. This is in Mexico where the change is more noticeable: 38% of the single split market already ran on R32 in 2023. And this despite the fact that the Mexican government has not translated the objectives to reduce HFCs consumption into mandatory regulations yet. With no significant regulatory framework for refrigerants in most of Latin American countries, the transition to alternative fluids is slow.

This article appears on the BSRIA news and blog site as 'Good Potential for AC Growth in Latin America despite challenges ahead' dated July, 2024.

--BSRIA

[edit] Related articles on Designing Buildings

- Absorption refrigeration.

- Africa tops world AC growth forecasts.

- Air conditioning inflation and supply chain crisis

- Air handling unit.

- BSRIA completes 2021 World Air Conditioning market studies.

- BSRIA: new Global Air Conditioning Market Studies.

- Building Automation and Control System BACS.

- Cooling systems for buildings.

- Dehumidification.

- Designing HVAC to resist harmful microorganisms.

- Evaporative cooling.

- Fan coil unit.

- Fresh air.

- Global Air Conditioning Study 2016.

- Growing focus on IAQ challenges for specifiers and HVAC manufacturers.

- Heat recovery.

- How to Use Your Air Conditioning Energy Assessments to Reduce Energy Costs.

- HVAC.

- IAQ developments accelerated by COVID-19 pandemic.

- Refrigerants.

- Thermal comfort.

- US among top 2020 global variable refrigerant flow markets.

- Variable air volume VAV.

- Variable refrigerant flow VRF.

- When hospital buildings aren’t healthy.

- Workplace air conditioning.

Featured articles and news

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

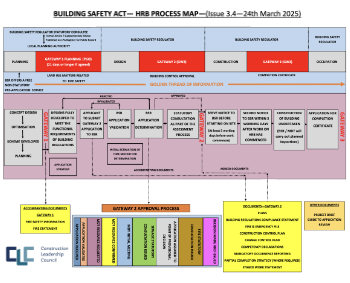

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.